Posting in Accounting: Definition and meaning

دسته: Bookkeeping

Double-entry bookkeeping is not a guarantee that no errors have been made—for example, the wrong ledger account may have been debited or credited, or the entries completely reversed. And so, if the business were to use an account payable module, an issued purchase invoice is delivered from a supplier and will serve as a credit to the module and main ledger. This would allow the account software’s system to automatically generate a debit entry on the most suitable expense account entry in the general ledger. After journal entries are made, the next step in the accounting cycle is to post the journal entries into the ledger.

BUSINESS IDEAS

By capturing the timing of revenue and expenses, it allows for a more comprehensive understanding of the company’s financial health. The ledger posting process moves journal entries to the general ledger. Ledger is the most what is posting accounting important book of accounts and is also known as the principal book of accounts. It has accounts of all the heads and gives the summary of each account with the balances and totals at a glance to take business decisions.

Step 5: Send your data

Software that can validate payment data against claims data and flag discrepancies catches the posting errors, finding root causes that can be rectified. Deploy tools that can detect underpayments, overpayments, denials, or adjustments. These tools should also compile these discrepancies in clear reporting and/or send alerts. Leverage analytics to generate reports and dashboards that provide insights into the performance of your payment posting and reconciliation processes.

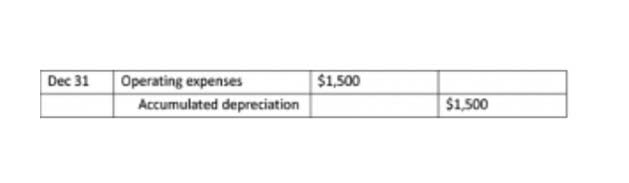

With Journal Entries

This ensures that your total debits and credits are equal (in this case, $1,000 debit to Computer Equipment equals $1,000 credit to Cash), and your accounting equation remains in balance. But where more than two accounts are involved in one single transaction and there is only one journal entry made, it is said to be a compound entry. There can be two accounts in the debit and one in the credit or one in the debit and two in credit part. However, the rule of posting is the same in this case too, but care should be taken while posting the amounts. When all entries are posted from the journal to the ledger, you get the desired information. Therefore, the journal is the original book of entry while the ledger is the final book of entry because it gives us the final position of accounts.

Posting is an important part of accounting since it helps to keep an updated record of all ledger balances & at the same time it can help a user to track how the ledger balances have changed over a period of time. This process has to be done to every single entry in the general journal. As you can imagine, this would be a full time job trying to post every entry manually. Modern computerized accounting systems perform the posting process automatically as soon as an entry is made in the journal. Let us illustrate how accounting ledgers and the posting process work using the transactions we had in the previous lesson. For example, ABC International issues 20 invoices to its customers over a one-week period, for which the totals in the sales subledger are for sales of $300,000.

- Believing direct human oversight of the posting process is more accurate, they ignore that the precision of machine processing virtually eliminates typographical and calculation errors that occur with manual entry.

- Moreover, automated systems can process payments at speeds far exceeding even the most efficient revenue cycle staff member, improving overall revenue cycle efficiency.

- It helps keep the updated records, but with the advancement of technology and the availability of various software, the posting in balance has become the traditional concept.

- Nevertheless, once the trial balance is prepared and the debits and credits balance, the next step is to prepare the financial statements.

- Therefore, the law requires all state and commercial companies to reflect them in an accounting system to keep track of individual items.

What Are the Five Steps of Posting in Accounting?

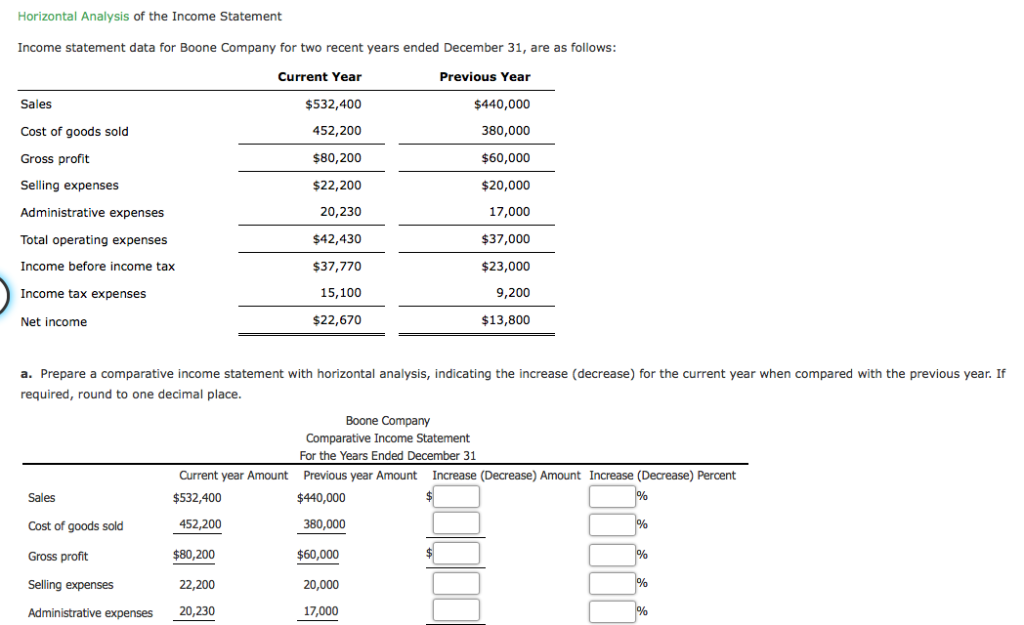

For CPAs and finance experts, closing the accounting cycle is essential. For example, MicroTrain saw a 57.73% rise in Service Revenue and a 53.55% drop in Salaries Expense. Following the cycle closely gives a true picture of a company’s finances.

From analyzing and recording transactions to posting them in the ledger, this fundamental accounting practice plays a crucial role in maintaining precise and reliable financial records. With the abundance of technological advancements in the fields of software, there are numerous accounting solutions provided by many technology giants like Oracle Suite, Tally, etc. Most of such software products provide a centralized repository to log entries into journals and ledger. Due to such accountancy software products, recording transactions have become far easier. There is no need to maintain all the books separately and reconcile manually as this software help in automating such redundant manual tasks.

Moreover, automated systems can process payments at speeds far exceeding even the most efficient revenue cycle staff member, improving overall revenue cycle efficiency. Advanced technologies like AI and machine learning identify underpayments trends so that root causes can be revealed and rectified. In manual accounting, posting is done by hand using a pen or pencil to enter journal entries into the general ledger.

Notice that after posting transaction #2, we now can get a more updated balance for each account. Post all the other entries and we will be able to get the balances of all the accounts. If posting accidentally does not occur as part of the closing process, the totals in the general ledger will not be accurate, nor will the financial statements that are compiled from the general ledger. Subledgers are only used when there is a large volume of transaction activity in a certain accounting area, such as inventory, accounts payable, or sales. For low-volume transaction situations, entries are made directly into the general ledger, so there are no subledgers and therefore no need for posting.

This information is provided in order to communicate the financial position of the entity to interested parties. In the beginning, we talked about the procedure of recording a transaction. Once the transaction is recorded, it must be transferred to the ledger accounts. This is where all of the journal entries recorded in the general journal are transferred to the individual account ledgers. You can think of the posting process like taking the journal entries and transferring them to T-accounts.