Contour step one: MMDI 2023 Q3 dashboard to possess GSE fund

دسته: quickpay payday loan

The newest Milliman Financial Default List (MMDI) was an existence default price imagine determined in the mortgage level for a portfolio off single-loved ones mortgage loans. On purposes of that it directory, default is understood to be a loan that is likely to be 180 weeks or higher delinquent along side lifetime of the mortgage. 1 The results of your own MMDI reflect the newest study order offered by Freddie Mac and Federal national mortgage association, having aspect dates ranging from .

Trick findings

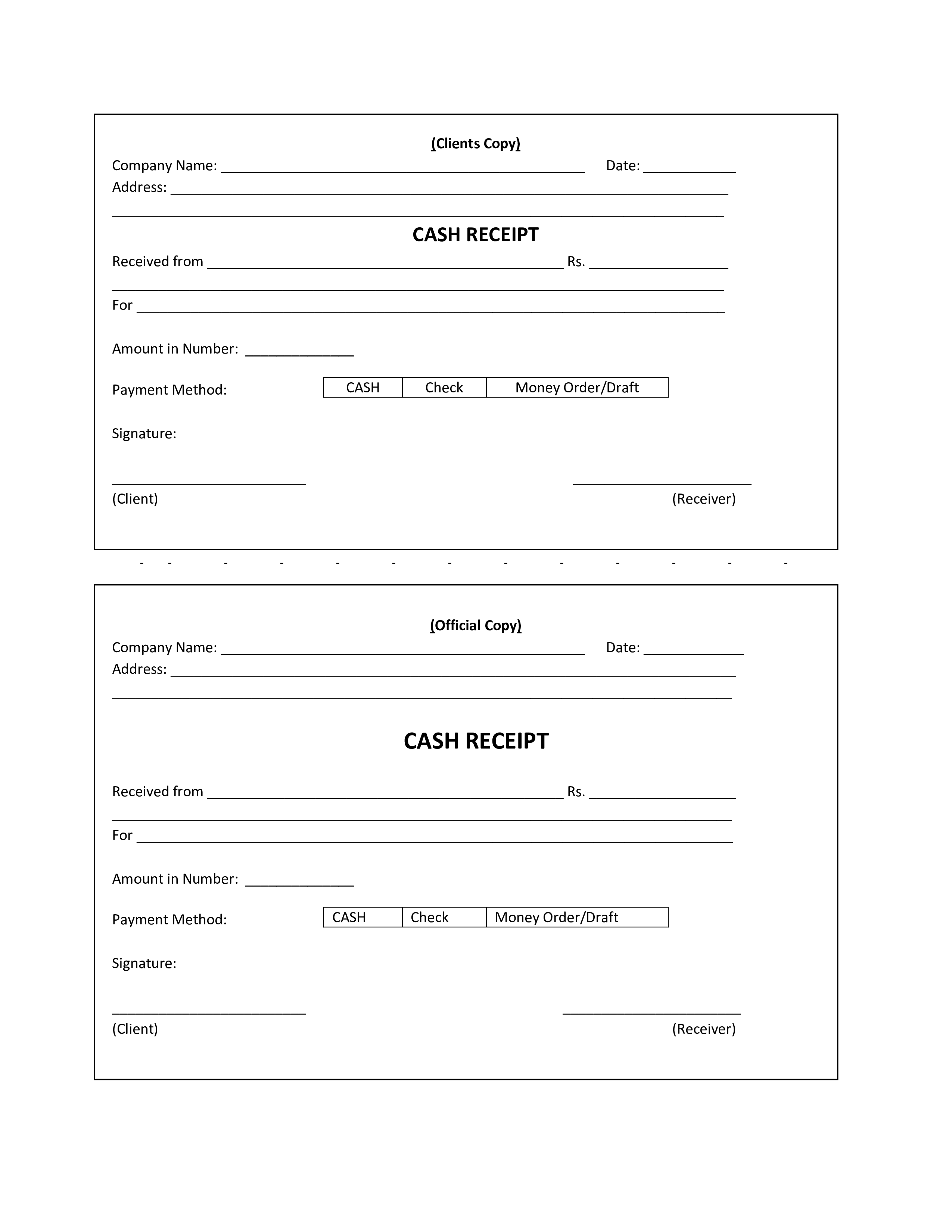

Getting money received in the third quarter (Q3) out of 2023, the worth of the brand new MMDI risen to step three.10%, upwards of 3.03% to own fund gotten during the 2023 Q2. So it increase stems from a slowing and you will slight loss of home rates really love projections in some locations. Shape step one comes with the one-fourth-end list results, segmented of the get and you may refinance financing.

Whenever examining one-fourth-over-one-fourth changes in the new MMDI, it is essential to keep in mind that this new 2023 Q2 MMDI philosophy have been restated given that our very own past publication, and you will have been adjusted from step three.02% to three.03%. This can be a direct result updating one another real family speed actions and you may forecasts having coming home price love.

Writeup on trends

Over 2023 Q3, our very own current MMDI performance reveal that home loan exposure has increased having government-sponsored agency (GSE) acquisitions. You can find around three areas of the MMDI: borrower chance, underwriting exposure, Nebraska loans and you will monetary risk. Debtor exposure actions the risk of the borrowed funds defaulting because of debtor borrowing high quality, initial equity reputation, and financial obligation-to-earnings proportion.

Underwriting exposure measures the risk of the borrowed funds defaulting on account of mortgage product features such as amortization sort of, occupancy reputation, or other things. Financial risk steps the possibility of the loan defaulting on account of historical and projected economic climates.

Borrower chance overall performance: 2023 Q3

Debtor chance Q3, with pick money proceeded making in the majority of originations at about 89% regarding overall volume. Though pick volume could have been coming down year-over-season, the caliber of fund away from a threat perspective keeps continued in order to feel good, staying the fresh default likelihood of the fresh mortgage originations reasonable.

Underwriting risk show: 2023 Q3

Underwriting exposure signifies a lot more chance modifications for property and you will mortgage features such occupancy position, amortization variety of, documentation designs, loan label, or other customizations. Underwriting risk remains lowest that’s negative for purchase mortgage loans, which are generally full-documentation, fully amortizing money. To have re-finance fund, the knowledge was segmented on cash-away refinance finance and you will speed/label re-finance finance.

It quarter, just as much as 70% off re-finance originations was cash-aside refinance fund. Previous increases inside the interest rates made rates/label refinance low-financial.

Economic chance overall performance: 2023 Q3

Monetary chance are mentioned from the considering historical and you may anticipated domestic prices. To own GSE finance, economic risk increased quarter over one-fourth, from one.54% within the 2023 Q2 to at least one.64% within the 2023 Q3. Following boom in casing pricing one happened over the course of pandemic, domestic speed adore could have been estimated to help you sluggish plus some decrease in some areas. The fresh new estimated reduced amount of household price appreciate has triggered a small rise in default risk to have 2023 Q3.

More resources for the housing industry, delight relate to our very own previous Milliman Notion blog post, Predicting the housing market: A financial mind-set of housing affordability and you will home prices offered at

The fresh new MMDI shows set up a baseline forecast regarding upcoming home values. Towards the amount actual otherwise standard predicts diverge from the current anticipate, upcoming e-books of MMDI will be different appropriately. For much more outline towards MMDI components of risk, check out milliman/MMDI.

Concerning Milliman Home loan Standard List

Milliman was specialist from inside the checking out advanced data and you will strengthening econometric activities that are clear, easy to use, and you will academic. I’ve put our very own assistance to simply help numerous customers for the developing econometric activities getting comparing home loan risk one another from the section regarding income and for seasoned mortgage loans.

The brand new Milliman Financial Standard Directory (MMDI) uses econometric modeling to grow a working design that is used because of the readers for the multiple ways, including analyzing, keeping track of, and you can ranking the financing top-notch this new manufacturing, allocating repair provide, and development underwriting direction and pricing. Because MMDI produces a lifestyle standard rate guess on financing height, its employed by members as an effective benchmarking unit into the origination and you will upkeep. The newest MMDI was constructed by the consolidating three key elements out of financial risk: borrower borrowing from the bank quality, underwriting attributes of your own financial, plus the monetary environment made available to the borrowed funds. This new MMDI uses a powerful data selection of more 31 billion mortgage loans, that’s current appear to to be sure they preserves the highest height away from reliability.

Milliman is just one of the prominent independent consulting firms on the business and also pioneered strategies, products, and choice around the globe. We are acknowledged management throughout the avenues i suffice. Milliman understanding has reached around the all over the world limitations, providing specialized asking attributes for the mortgage banking, employee masters, medical care, insurance and you may monetary qualities, and you can assets and you may casualty (P&C) insurance rates. Within these circles, Milliman specialists suffice an array of latest and you will emerging areas. Members understand they could count on us since skillfully developed, trusted advisers, and creative situation-solvers.

Milliman’s Mortgage Habit try intent on bringing strategic, quantitative, and other consulting features so you can top groups on home loan banking business. Earlier in the day and you will newest members tend to be some of the country’s premier financial institutions, private home loan warranty insurance vendors, financial warranty insurance vendors, institutional dealers, and you will governmental groups.

step one Such, in the event the MMDI try ten%, next i anticipate ten% of one’s mortgage loans came from that times being 180 months or even more outstanding over its lifetimes.