The Accounting Equation: Assets = Liabilities + Equity

دسته: Bookkeeping

The assets of the business will increase by $12,000 as a result of acquiring the van (asset) but will also decrease by an equal amount due to the payment of cash (asset). If you were to add up all of the resources a business owns (the assets) and subtract all of the claims from third parties (the liabilities), the residual leftover is the owners’ equity. Owners’ equity must always equal assets minus liabilities. Liabilities must always equal assets minus owners’ equity. Suppose a company spends $100 to purchase a chair with cash. The company’s PP&E value increases by $100 because it now owns an extra chair worth $100.

Assets Always Equal Liabilities Plus Equity

- HBS Online’s CORe and CLIMB programs require the completion of a brief application.

- The system is the go-to accounting method of the modern day.

- This type of report allows for a quick comparison of items.

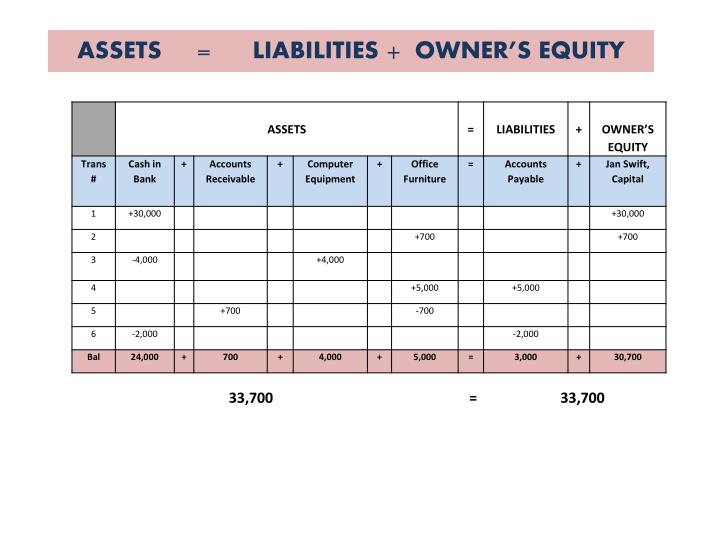

- Every transaction alters the company’s Assets, Liabilities and Equity.

- But its Cash & Cash Equivalents value decreases by $100 because it used $100 to buy the chair.

For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. Record each of the above transactions on your balance sheet. Add the $10,000 startup equity from the first example to the $500 sales equity in example three. Add the total equity to the $2,000 liabilities from example two. In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance.

What Are the Key Components in the Accounting Equation?

This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might anything that can go wrong will go wrong refer back to the balance sheet. Balance sheets are one of the primary statements used to determine the net worth of a company and get a quick overview of it’s financial health. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack. When the total assets of a business increase, then its total liabilities or owner’s equity also increase.

What Is Shareholders’ Equity in the Accounting Equation?

In our examples below, we show how a given transaction affects the accounting equation. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity. This statement is a great way to analyze a company’s financial position. An analyst can generally use the balance sheet to calculate a lot of financial ratios that help determine how well a company is performing, how liquid or solvent a company is, and how efficient it is. Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit.

This account is derived from the debt schedule, which outlines all of the company’s outstanding debt, the interest expense, and the principal repayment for every period. Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets.

How to Use the Accounting Equation

Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity. Although the balance sheet always balances out, the accounting equation can’t tell investors how well a company is performing. Changes in balance sheet accounts are also used to calculate cash flow in the cash flow statement. For example, a positive change in plant, property, and equipment is equal to capital expenditure minus depreciation expense.

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. This line item includes all of the company’s intangible fixed assets, which may or may not be identifiable.

If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets.