Just how to Pay a mortgage in Five years

When you not keeps a home loan to spend, you can utilize those funds for other things such as paying, performing faster or retiring early.

Luckily for us that you don’t need waiting many years to love this economic liberty. You could potentially repay your mortgage very early and go it at some point than do you believe.

If you would like pay off your financial at some point, it is important to know how per percentage leads to cutting your loans.

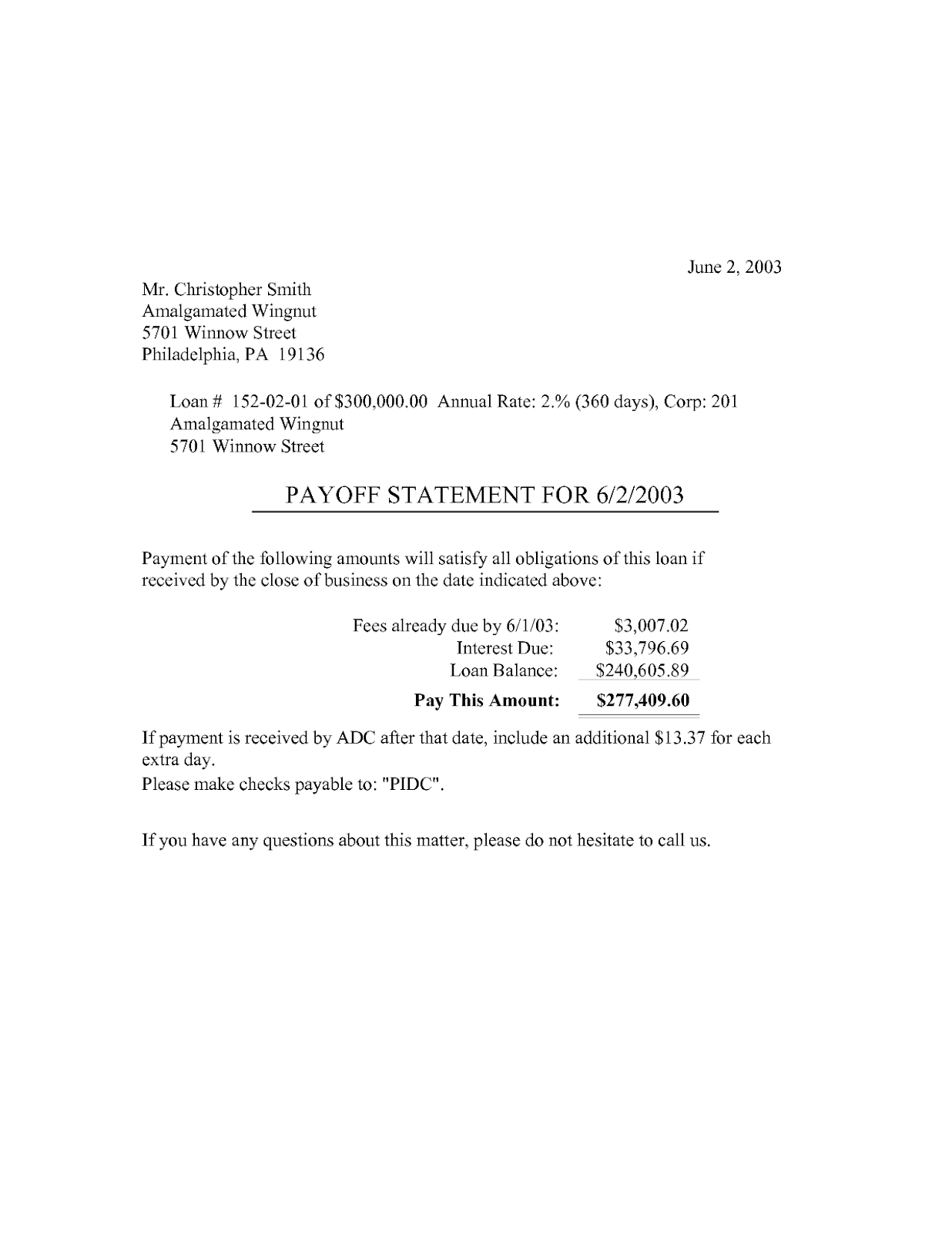

Your home loan repayments become different parts. The first area is actually dominant, the genuine number your obtain to buy your domestic. Eg, when you yourself have an excellent $300,000 financial, the main was $300,000.

In addition to the principal, mortgage payments likewise incorporate interest. This is basically the commission you have to pay to own borrowing from the bank money from the fresh new bank.

Interest percentage is calculated once the a percentage of the the principal balance. Your unique interest, but not, utilizes individuals products such as your creditworthiness and you may markets requirements. When you yourself have good six% rate of interest on your $3 hundred,000 financial, you’ll pay in the $18,000 in desire per year, otherwise $1,five-hundred 30 days.

Once you help make your mortgage payment, a number of it goes to help you reducing the number you borrowed (the principal), because people discusses the cost of credit (the eye). Because you keep to make repayments, the balance decreases while gain much more possession regarding assets. This is titled collateral.

It’s important to keep in mind that at the beginning of numerous years of good 30-seasons repaired-price mortgage, a much bigger amount of your monthly payment would go to paying rates of interest (simply a tiny part visits reducing the principal).

Yet not, the amount you borrowed from in the interest slowly decrease as you circulate further together throughout the financial identity. Up to now a move occurs and of payment begins chipping away within dominant.

To settle their mortgage shorter, you’ll need to make most money toward the main-at the top of their normal monthly premiums. Very let’s say you create an extra commission regarding $200 on the the main each month. It most fee assists reduce steadily the prominent reduced, therefore shortening committed it takes to pay off the loan.

Was repaying the mortgage very early wise?

After you pay back their home loan prior to agenda, your somewhat slow down the total interest paid back over the whole mortgage period. This will potentially rescue thousands of bucks.

Less stress is additionally an advantage. Way of life home loan-totally free can bring comfort, letting you reroute that cash for other financial needs, such preserving to possess later years, an excellent child’s training, or other opportunities.

- High-desire bills: When you https://paydayloansconnecticut.com/daniels-farm/ have almost every other a good bills with large interest levels, like personal credit card debt or signature loans, it will be best to focus on settling these costs basic.

- Shortage of earnings: Quickening home loan benefits setting to make larger repayments, that’ll lay a-strain on your funds. It is important to carefully evaluate your current economic visualize and also make sure you additionally have enough income to fund your own almost every other financial responsibilities.

Inadequate coupons: Likewise, you could disregard paying a home loan early or even have enough from inside the savings getting a crisis. Preferably, you will have a minimum 3 to 6 months’ worth of cost of living.

Suggestions for repaying home financing early

To pay off the home loan early, you’ll need to enhance your monthly payments thereby applying a lot more loans for the dominant balance.

For many people, this may encompass finding an easy way to enhance their earnings, otherwise re also-budgeting and you will lowering on the so many expenses. Re-budgeting plus need figuring the costs and figuring out how much cash way more you’ll want to shell out every month.

- Recasting: Financial recasting concerns to make a lump sum with the the main harmony, then recalculating the brand new payment in accordance with the shorter harmony. It doesn’t affect their interest rate or financing title, nevertheless can reduce your payment per month and you can provide finance. You can then utilize this money while making more principal repayments.

- Biweekly repayments: Instead of and also make a single payment, you can pay one to-half of your homeloan payment most of the two weeks. Which results in twenty six half-money a year, which is the equivalent of 13 full monthly obligations. Biweekly costs assist processor aside in the dominant balance faster, shortening the general title of financing.

- Lump sum payment money: For individuals who discovered an unexpected windfall particularly an income tax refund, incentive, or genetics, explore a share (and/or whole amount) to simply help reduce your own financial prominent.

The bottom line

Merging one or more of these actions that have boosting your monthly fee is speeds the mortgage and pay-off the balance many years prior to.

Ahead of using these strategies, make sure that your loan has no a prepayment punishment-and constantly incorporate a lot more payments with the dominant equilibrium.