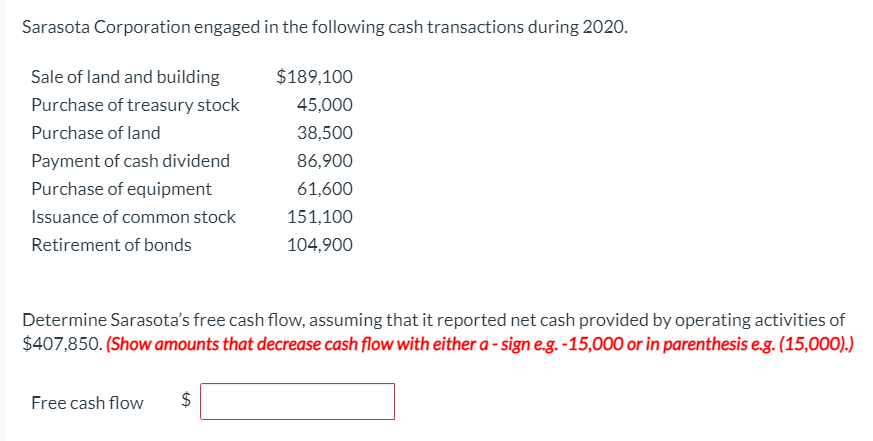

Borrowers utilising the first Time Advantage mortgage might have access to 1 of your own adopting the DPA solutions:

دسته: what's a cash advance

In preparations, let will come in the form of a give, in addition to debtor may use gift currency to help pay money for a portion of the household. However the details of for each program vary, so those who need it will want to look very carefully on one another to determine what you to match their requirements most useful.

To ascertain if you will be qualified to receive this method, you’ll need to consult with financing officer

- Bend 6000: Located a $six,000 interest-free loan to have down payment and you can settlement costs, and no monthly obligations expected. You ought to pay-off the initial $5,000 when you offer, refinance, transfer, or become repaying the borrowed funds

- Bend step 3% Loan: You could borrow step three% of first mortgage underneath the same terms given that Fold 6000 loan.

- Lover Match: Might receive the currency due to the fact a no-appeal, deferred loan that you can use towards the deposit and you can settlement costs. Exclusive to particular MDHCD mortgages.

- very first Day Advantage 6000: Receive a beneficial $six,000 notice-100 % free mortgage with no repeating costs. But not, for individuals who sell otherwise refinance just before completely paying down the mortgage financing, make an effort to repay the mortgage.

- 1st Date Advantage DPA: You could potentially borrow around 3%, 4%, or 5% of one’s first mortgage mortgage to fund their downpayment and closing costs.

- HomeStart: In the event the income is equivalent to otherwise greater than 50% of your own area average income (AMI), you ount.

See MDHCD’s webpages for more information, due to the fact all these agreements provides some other certificates. And look for almost every other homeownership direction software within the Maryland for the HUD’s site. 1

MassHousing, a separate houses department when you look at the Massachusetts, can offer around $50,000 for the down-payment guidance, dependent on the place you want to buy property.

To ascertain whether or not would certainly be eligible for this choice, might need to consult that loan administrator

- Up to $50,000 in multiple towns and cities, including: Attleboro, Barnstable, Brockton, Chelsea, Chicopee, Everett, Slip River, Fitchburg, Framingham, Haverhill, Holyoke, Lawrence, Leominster, Lowell, Lynn, Malden, Methuen, The latest Bedford, Peabody, Pittsfield, Quincy, Randolph, Revere, Salem, Springfield, Taunton, Westfield, and Worcester.

- Around $30,000 in every Massachusetts groups

MassHousing cannot upload program information on their webpages. To own a listing of other local apps inside the Massachusetts, check out HUD’s website. 1

The fresh Michigan County Construction Advancement Power (MSHDA) even offers an excellent DPA system to greatly help audience that have online payday loan Arizona closing costs and you may a down payment.

MI 10K DPA Mortgage

The latest M1 10K DPA Financing brings doing $10,000 from inside the down-payment recommendations into the specified Zip codes for people who loans your property pick that have MSHDA’s M1 Loan.

Each other first-date Michigan homeowners-anyone who has perhaps not purchased a house over the last three years-and you may recite customers in the certain areas qualify on the program. House money limits pertain, and they are different dependent on household members dimensions and you may property place. The most conversion rates for everybody qualities regarding the county try $224,five-hundred.

The very least credit history out of 640 must be eligible, or 660 should you want to buy a made house or apartment with several sectionspleting a homes education way is even needed.

You’ll find a listing of qualified zero requirements towards the MSHDA webpages. And get a summary of most other homeownership assistance software in Michigan towards the HUD’s web site. step one

To find out if or not you’d be entitled to this program, you’ll need certainly to consult with that loan manager

- Payment per month Financing: You might obtain as much as $18,000 in one rates you pay on your first-mortgage. Over a beneficial ten-season several months, shell out you to definitely out-of when you look at the monthly installments.

- Deferred Percentage Mortgage: First-go out consumers can borrow up to $sixteen,five hundred free from interest. Zero repayments are needed, but the balance becomes due once you over settling the fresh new financial, re-finance, or promote our home.