695 Credit rating Personal loans: Unlocking Beneficial Borrowing Solutions

A credit history regarding 695 is recognized as higher level and that is a sign from a responsible borrower just who takes installment loans online Nebraska care of borrowing and you will loans better. When you have a credit history off 695 or higher, you may have access to numerous borrowing products and you will qualities, as well as unsecured loans that have favorable terms and conditions. discuss just how a powerful credit rating is also discover doors to attractive consumer loan options, empowering one to reach finally your economic requirements.

Numerous products go into figuring your current credit score also payment record, amounts due on account, length of credit score and you can the brand new personal lines of credit opened has just. A single later payment you can expect to negatively effect their score by the up to help you 100 things!

When you need to care for a great credit score or improve upon a preexisting one then it is crucial that you create timely money for the all the expense and give a wide berth to taking out fully unnecessary the new lines out-of loans immediately.

Personal loan that have 695 Credit score

When you have a beneficial CIBIL rating away from 695 and require a beneficial personal bank loan, there are numerous things you can do to improve their probability of recognition. First and foremost, its essential to learn your credit score and you will choose any inaccuracies or mistakes which are inside your score. If you discover one discrepancies, punctually improve a dispute towards the borrowing bureau so you’re able to rectify all of them.

2nd, work with boosting your borrowing from the bank use proportion if you are paying from present expense and you will bank card balance. A lowered credit utilization proportion is positively impact your credit score. In addition, ensure that you generate all coming payments promptly so you’re able to establish a positive credit score.

Before applying getting an unsecured loan, determine your debts and view the total amount your certainly need. Trying to get that loan within your installment strength can make you are available even more creditworthy to lenders. Believe dealing with finance companies or loan providers the place you possess an effective pre-existing relationship, because they may be way more happy to consider carefully your software situated in your record together.

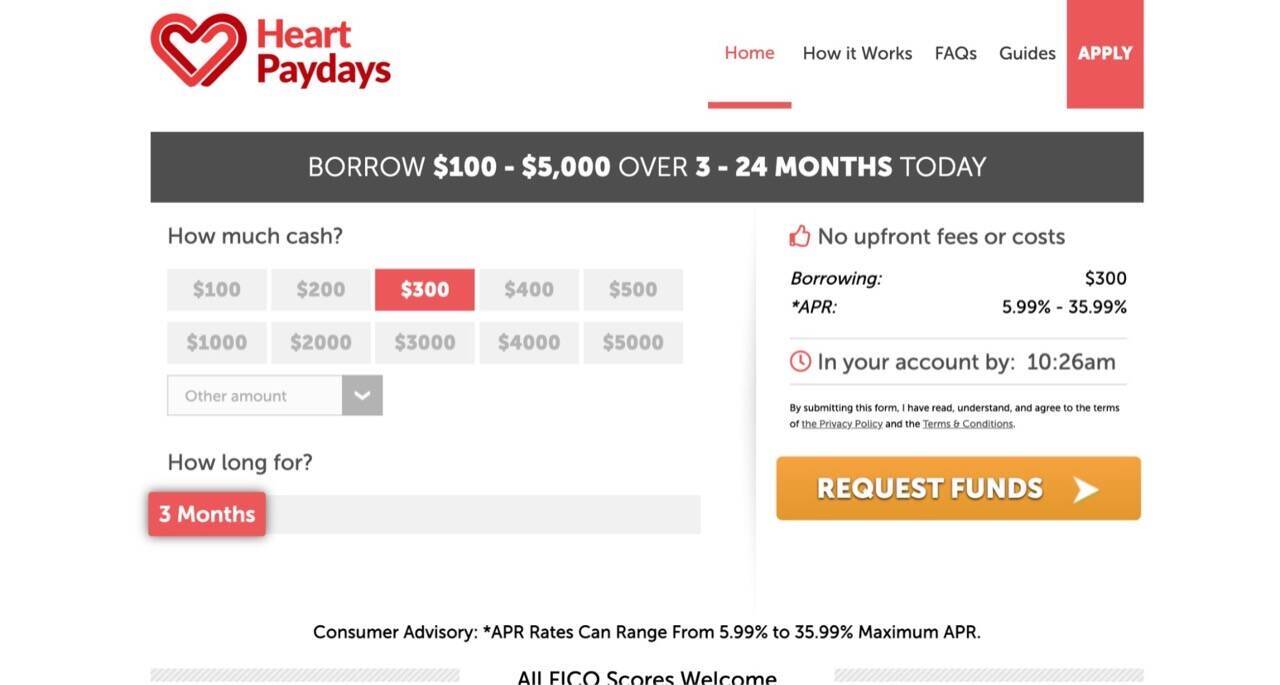

Lastly, if you find they challenging to safe that loan away from antique lenders, explore option lending systems one to focus on people who have moderate borrowing from the bank ratings. These types of platforms can offer way more flexible small print you to align with your demands and you can financial predicament.

If you take this type of methods to change your creditworthiness and examining individuals financial loans, you could enhance your odds of getting a personal loan even having a good CIBIL rating out-of 695. Always examine interest levels and words out of various other lenders prior to and make a final decision.

an effective. Down Interest rates:

Loan providers see people with higher credit scores as the straight down-exposure consumers, and reward all of them with lower interest rates for the personal loans. Thus it can save you a lot of currency towards the attract costs over the life of the mortgage.

an effective. Unsecured Unsecured loans:

This type of money do not require guarantee and are generally created only toward your own creditworthiness. With a credit score out-of 695, youre expected to qualify for unsecured unsecured loans which have beneficial terms.

b. Secured finance:

Whenever you are your credit rating is essential, secured finance need guarantee, such a family savings, a certification out-of deposit (CD), or any other valuable assets. That have increased credit score can always seriously impact the terminology of these loans.

c. Debt consolidation reduction Fund:

When you have multiple bills with different interest rates, a consumer loan can be used to combine all of them towards the a great single, a lot more down payment per month. Having a good 695 credit rating, you could safer an integration loan having a stylish interest, saving you into focus and you will make clear your finances.

4. Methods for Obtaining Top Personal loan Offers

Despite a credit history out of 695, it’s essential to make a plan to make sure you earn an educated possible personal loan now offers:

apare Loan providers:

Never accept the initial mortgage present located. Look around and you will contrast financing terminology, interest rates, and you will fees out of several loan providers to get the very good choice.

b. Manage a reliable Income:

Loan providers will also think about your money balances and you can personal debt-to-earnings proportion whenever assessing your loan application. Proving a reliable money and you may manageable loans will enhance your chances out of approval.

c. Comment Your credit history:

Before applying for a personal loan, review your credit history your discrepancies or discrepancies that’ll affect your credit rating. Argument any mistakes the thing is that and you can fix them punctually.

d. Stop Trying out Too many Personal debt:

When you are a credit history opens potential, it’s necessary to borrow responsibly. Sign up for financing only if required and prevent overextending your self financially.