However,, however, borrowing tightened up, but what happened are secondary

دسته: near me cash advance

Thus these people were money that have been perhaps not gonna be securitized because of Fannie mae, Freddie Mac computer, otherwise because of government funds, Ginnie Mae Ties, that’s FHA financing, Virtual assistant finance, and USD outlying housing finance

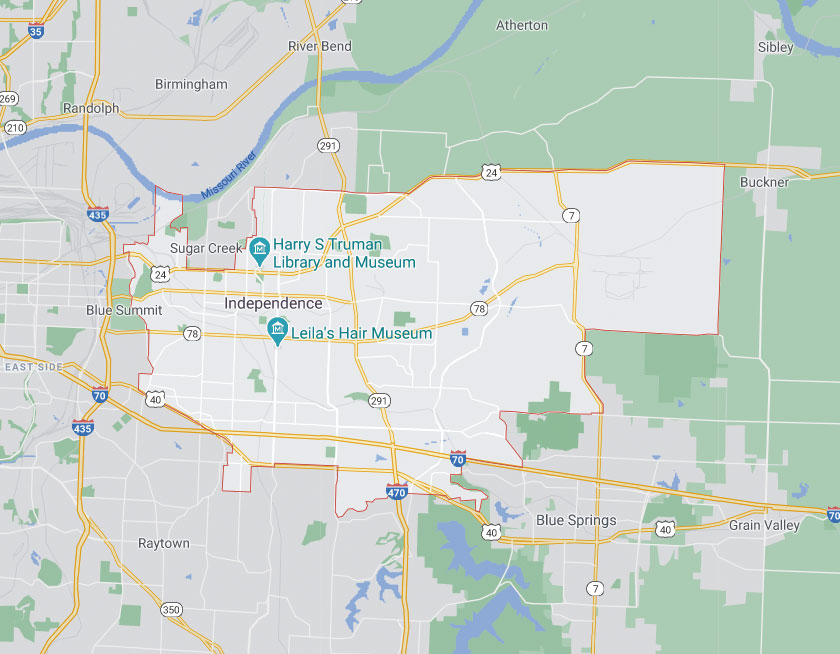

Tim Peterson: Most of the areas were where, a lot of the large, a great deal more competitive places, hence is actually every where out of Arizona on front range of Colorado, the Denver sector, Utah, [crosstalk ]-

Ryan Isaac: Is this type of merely some body swinging? After all, all locations you happen to be naming is metropolitan areas one, only anecdotally, We listen to people transferring to and you may attempting to go on to. Talking about very popular metropolitan areas folks are type of migrating to help you. Is that they, or is it simply established city people that just keeps [crosstalk ]?

Tim Peterson: It is each other, along with to look at the new class of the nation too. After all, the typical age an initial-go out home client nevertheless in the usa is actually thirty two or 33 across the You.

Tim Peterson: Yeah, I am kind of in between. You have the Baby boomers, and therefore the inhabitants transpired. It was not till the Millennial age group it started coming back right up. So we have significantly more earliest-big date home buyers going into the field, I am talking about statistically, than ever. We have had one to ton for the past while, and it’s really continuing. Very you will find simply simple population need for property [inaudible ] across-

Tim Peterson: … outside financial gains which might be going on in lots of these types of municipalities and you may MSAs which i merely revealed. Therefore you will find an excellent confident request, which will be 100% the good news. What i’m saying is, that is where we’re standing on record low interest. Sure, you will find possessions enjoy, but most of the home designers … Discover a study one went in order to house developers, and you can I am simply attending speak where I’m immediately.

Tim Peterson: 80% of these mentioned that they’d no agreements into the adjusting rate to their assets during this seasons, that is the best thing, since the many people are planning, Really, will they be going to cure they? There is certainly particular classes in which perhaps a cost drops a good tresses, but there are alot more that said they were planning to raise costs of your leftover 20% than there had been that being said these people were planning straight down they.

Ryan Isaac: Since you’ve heard all of our podcast, possibly there is a question regarding your earnings you’ve planned to ask. It’s not hard to get a reply. Anything you create is collect one phone, give us a call on (833) DDS-Decide to set-up a scheduled appointment, or you should not call us, you can just check out the website on dentistadvisers, click on the Publication Free Visit switch, and put it. It is 100 % free. Do it now.

Ryan Isaac: Just before, three months back, whenever all of the COVID posts broke, in which it was every top, you said plenty of confident pent-right up demand, extremely. They truly are just awaiting brand new home and you will advancement becoming complete.

Both might call them low-certified financial or low-QM finance

Ryan Isaac: We should chat a little bit regarding the cost, method of getting borrowing from the bank, how the lending standards features changed since the ’08?

Tim Peterson: That is like all something. Whatever the you may be starting, almost always there is observed Killen loans impression that some thing have a number of complications it cannot, and it’s really usually associated with simply often too little skills or a lack of elite group support. Very things, handling a professional was of the utmost importance.

Tim Peterson: You don’t have to end up being the jack of all trades. After all, its as to why I label you against a good investment angle. It is as to the reasons some body calls anybody at all like me away from a home financing position. This can be also appropriate with the jumbo markets, due to the fact there can be financing limits from what you can aquire money to possess Federal national mortgage association and you can Freddie Mac.