Really does credit score amount to have a secured mortgage?

دسته: payday loans

A lender will have to know whether you can afford this new month-to-month payments towards the financing shielded by the domestic. Might ask about your earnings, costs and you will expenses.

Your loan-to-value ratio

The more collateral you hold in your home, the fresh smaller exposure lenders often deal with. This might indicate all the way down costs in your money. Put another way, the more equity you have got, the greater amount of you might probably borrow.

Your credit score

You don’t need a spotless credit file to locate a price, but lenders will always want to see their borrowing record and you will any CCJs.

The objective of the loan

Certain lenders have the precise list of appropriate or unsuitable purposes, so it’s preferable to enjoys an obvious mission in your mind when your pertain.

Eligibility

- Your credit rating, including your early in the day credit score

- The total amount we wish to acquire and mortgage term

- How much cash you really can afford to repay monthly, based on their complete earnings.

- Brand new equity on your possessions. Even although you possess bad collateral, you might still be eligible for a protected mortgage

- Brand new lender’s standards.

Evaluate the report on mortgage eligibility for further advice on whether or not you can make an application for your own covered financing.

Credit rating isn’t what you, but it’s crucial. With money covered into possessions, your credit score is not the just foundation thought. Keep in mind that a much better credit rating might suggest an excellent all the way down rate of interest.

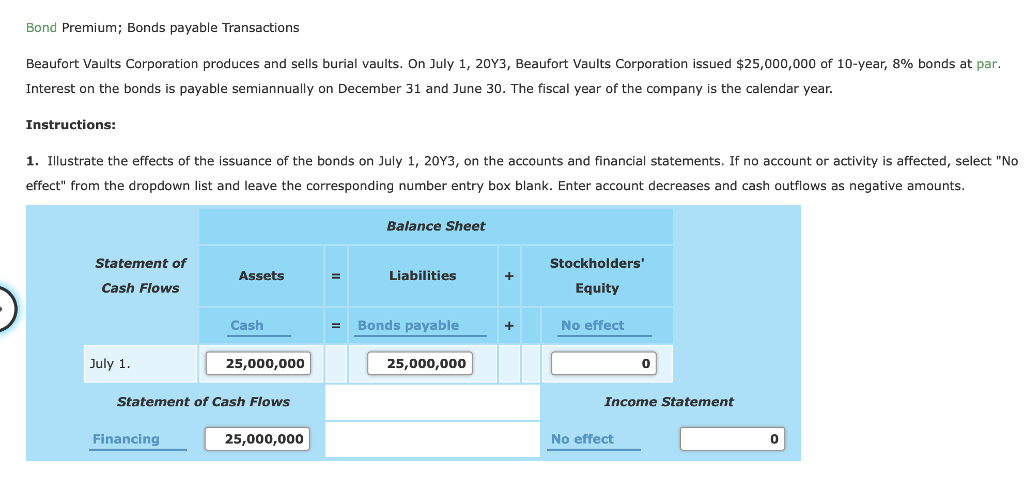

Member example

Secured personal loans – Rates start within 6.59% adjustable. I also have a selection of arrangements having costs up to thirty-six.6%, providing us with the flexibility in order to discover a loan you to definitely caters to your circumstances.

Affiliate example: for folks who use ?34,480 more a decade, initial towards a predetermined rate for five age at eight.60% and for the left five years for the loan providers fundamental variable rates of 8.10%, might build 60 monthly payments from ? and you may sixty monthly installments regarding ?.

The total repayable was ?56, ( This may involve a loan provider payment out of ?595 and you can an agent fee away from ?4137) The general pricing for evaluation was 11.3% APRC member.

Exactly what records do I want getting a secured mortgage?

Once you have going your own shielded application for the loan on the web, we’re going to get into touching because of the cellular telephone to discuss a few information. We will ask for further information, including:

- Individual monetary info

- A career standing

- Information on your revenue

We will probably and talk about everything decide to make use of the mortgage to possess. Above all, we’re going to have to collect particular facts about your home. You might just be eligible for a secured financing whenever you are a beneficial citizen.

And then make all of our call to you circulate as soon as possible, it could help possess some specifics of your financial state at hand. Latest lender comments, payslips and you may home financing declaration carry out all be helpful in situation one thing appears you to we want to know about your.

Funds away from Norton Financing

Norton Money can help come across financing comparable to your own financial situation plus individual means. Therefore examine funds in lieu of giving one product for example since the a loans Boligee developing area otherwise bank, we can look at the full market for just that.

The flexibility of your financing things we find form you could potentially acquire away from ?step 3,000 so you can ?five hundred,000, more than any months between one to and you may 3 decades.

Once you upload your application, we’ll make a keen inside the principle’ choice in 24 hours or less. You’ll receive a direct payment inside doing two weeks. Select our secured loan calculator and watch how much and for the length of time you can afford in order to borrow, and you can to improve the brand new sliders in order to satisfy your ideal terminology.