Sadly it rudely exclaimed it would not do the mortgage the second day while the “you really have 19 concerns”

I just ordered property to have $600k having 5% off. We ran from inside the thought $30k or so when you look at the electrical work, and therefore became nearly $175k in an entire guys inside the treatment. The house is basically the latest, and you may worth 775 so you can 825k now, so we didnt eliminate all of our shirts however, not at all an excellent experience.

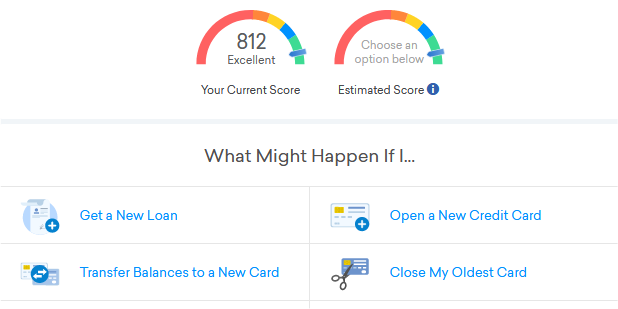

Much time story short, 800 fico going in has become on 640 so you can 655 situated on which get and you will Bureau. I’ve almost 200k in revolving debt, with about 125k of this becoming highest appeal. No lates actually, zero series, nevertheless use is actually killing my rating. Domino feeling, Citi noticed my other notes approaching restrictions Perhaps as well as reduce my range down of the $25k that it appears as if it had been maxed out.

That have merely ordered the house we’d throughout the 10 issues to possess looking the pace, in addition to we had a past price fall courtesy and you can on account of time needed borrowing from the bank taken once again. The whole go out I’d do almost anything to come back and buy a separate household, however now that it is complete I would not feel delighted and we will grow old right here (waterfront to the Tampa bay, i seafood off the pier every night, its incredible) .

I’m spending $13k a month within the lowest money already for instance the family, and most from it goes toward attention. We make regarding 25k terrible normally (commission) monthly, therefore their rigorous shortly after fees however, our company is okay. Needless to say I want to get this to highest attract personal debt refinanced and so i can begin and then make a damage on the overall. At the twenty five% notice now its a great Gd laugh.

With my income and you may asked coming earnings a house equity loan or heloc sound right, and that i can easily knock regarding several thousand a month out-of the balance

I had approved because a person in sdfcu nonetheless cannot perform some heloc because of current questions while increasing in debt. We informed your woman the entire facts very However I might have a recent rise in loans, and you can she said nothing wrong score is more than 580 we can perform 95% cltv. We owe 565k already, so if we see an appraisal away from $750k, 95k will get me 145k approximately just after will set you back. That will be a big help, which have a payment nearer to $1000 a month. Well uh yes, since you may already know I purchased property (twice) inside the Oct. At that time my fico try 617, I reduced 25k indebted to boost they into 640s now.

I’m accepted to have subscription having signature but they are advising me my spouse needs to go on the loan, and her borrowing is similar but get is in the 500s on account of lack or records up until recent buildup regarding debt. In Fl on each almost every other home loan or heloc We have over, lover does not need to getting a borrower.

The brand new rehab drained our very own dollars reserves and now we unsealed account at flooring and you can decoration, house depot, and you will a good wells Fargo personal loan getting 40k

One suggestions about the place to start right here? Borrowing union appears like the first choice having a 2nd lien. We have no military into the family members. I registered acc to own sdfcu.

I could perform an entire re-finance of one’s initial mortgage as well, however, We an in the 4.75% (got lender shell out our closing costs) to your good jumbo loan, and i cannot come across bringing one to reasonable within 640 FICO.

I experienced people get a bit too far toward my personal organization on a different community forum when i mutual this. I’m trying to find some tips on these products and lenders, to not ever learn which i must offer the house. I could likely build more 400k into the 2019, so this discomfort are temporary and you may I have already been from inside the much worse shape in advance of that have an ex wife robbing myself blind. Repaid 100k with debt which have 75k into the home money into the couple of years in those days. Disappointed So you’re able to voice snooty, I just want some assistance should you be ready to bring they.