Analyzing Income Statements Notes & Practice Questions CFA

دسته: Bookkeeping

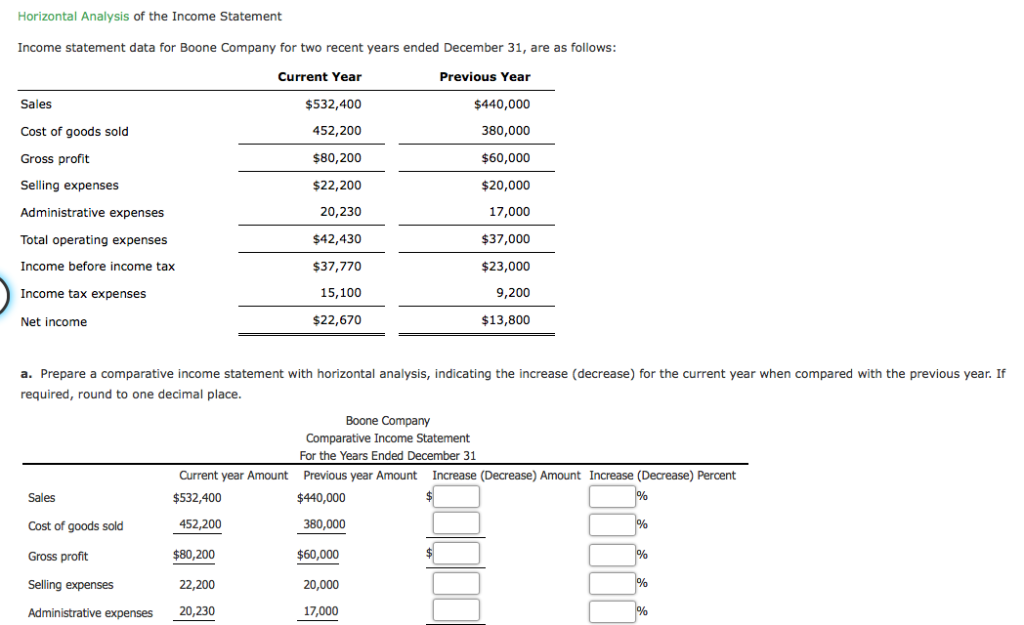

Horizontal analysis of financial statements involves comparison of a financial ratio, a benchmark, or a line item over a number of accounting periods. Horizontal analysis allows the assessment of relative changes in different items over time. It also indicates the behavior of revenues, expenses, and other line items of financial statements over the course of time. Indeed, sometimes companies change the way they break down their business segments to make the horizontal analysis of growth and profitability trends more difficult to detect.

How to Read & Understand an Income Statement

Horizontal analysis is a financial analysis technique that compares financial data over multiple reporting periods to identify trends and patterns in a company’s business cycle. Horizontal analysis involves comparing line items in financial statements across consecutive periods, usually a recent year to a base year. Both horizontal and vertical analysis are useful tools for analyzing financial statements and can be used together to gain a comprehensive understanding of a company’s financial performance.

Differences Between Horizontal Analysis & Vertical Analysis

We can perform horizontal analysis on the income statement by simply taking the percentage change for each line item year-over-year. Horizontal analysis makes financial data and reporting consistent per generally accepted accounting principles (GAAP). It improves the review of a company’s consistency over time, as well as its growth compared to competitors. It is up to the analyst’s discretion to choose the appropriate number of accounting periods.

Featured Online Resource

- You can do horizontal analysis using only two periods for the comparison, but it’s highly recommended you use more to avoid drawing and acting on less accurate conclusions.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- Understanding how each component impacts overall profitability is essential for investors, creditors, and stakeholders when making informed financial and investment decisions.

- You can choose whatever interval (month-over-month, year-over-year, etc.), but each iterative financial statement should be equal distance away regarding when it was issued compared to other bits of financial information.

- Our platform features short, highly produced videos of HBS faculty and guest business experts, interactive graphs and exercises, cold calls to keep you engaged, and opportunities to contribute to a vibrant online community.

In the final section, we’ll perform a horizontal analysis on our company’s historical balance sheet. The first step to performing a horizontal analysis is to calculate the net difference — in dollar terms ($) — between the comparable periods. We’ll start by inputting our historical income statement and balance sheet into an Excel spreadsheet. In other words, vertical analysis can technically be completed with one column of data, but performing horizontal analysis is not practical unless there is enough historical data to have a useful point of reference. For instance, if a most recent year amount was three times as large as the base year, the most recent year will be presented as 300.

Using vertical analysis, an analyst evaluates the income statement of a technology firm to understand how each line item contributes to total revenue. The analysis reveals that while revenue has increased, marketing expenses as a percentage of revenue have grown disproportionately. This shift in expense structure could indicate that the company is investing heavily in customer acquisition. The analyst assesses whether this investment aligns with increased market share or improved revenue growth, providing insights into the company’s strategic choices and potential for long-term profitability.

International Financial Reporting Tool perfect reporting according to IFRS

For this, we compare the absolute change ($) and percentage change (%) in all the line items from one period to the other. One should ideally take three or more accounting periods/years to identify trends and how a company is performing from one year/accounting period to the next year/accounting period. A company’s financial statements – such as the balance sheet, cash flow statement, and income statement – can reveal operational results and give a clear picture of business performance. In the same vein, a company’s emerging problems and strengths can be detected by looking at critical business performance, such as return on equity, inventory turnover, or profit margin.

For example, a low inventory turnover would imply that sales are low, the company is not selling its inventory, and there is a surplus. This could also be due to poor marketing or excess inventory due to seasonal demand. Horizontal analysis also makes it easier to detect when a business is underperforming. Consistency and comparability are generally accepted accounting principles (GAAP).

However, you can do this very quickly for multiple years, particularly if you’re interested in long-term trends. For this example, I will carry out the analysis of the data reported for 2021 and 2022. However, you can do this quickly for multiple years, particularly if you’re interested in long-term trends. I’m sharing tales from the trenches of over a decade of finance and accounting experience from Fortune 100 companies to spirited startups. Now comes the fun part—analyzing what these changes mean to business performance.

The horizontal analysis formula in this case for the variance column is shown in the example below for the revenue line item. Rather than an item in the statement, a whole accounting period is used as the base period and its items are used as the base elements in all comparative statements. Horizontal analysis may be executed in a manner that makes a company’s financial health look way better than it is. It is mostly done by companies when presenting external stakeholders with information about the business in a bid to deceive them.

Such analysis provides valuable insights into why any of these line items rose or fell sharply or markedly in year 2, compared to year 1. For example, net income could fall sharply in year 2, despite a rise in sales, due to a marked rise is interest on a home equity line of credit in the cost of goods sold, marketing expenses, administrative expenses, and/or depreciation expenses. For example, an analyst may get excellent results when the current period’s income is compared with that of the previous quarter.

This suggests a Rs. 30,000 increase in the cost of products sold during the said period. In the same way, the absolute change is as described below if the cost of products sold was Rs. 60,000 in 2019 and Rs. 90,000 in 2020. For example, let’s say Reliance Industries had revenue of Rs.5,00,000 crores in 2023 (base year) and revenue of Rs.6,00,000 crores in 2024 (current year). Insert a column to the right of ‘2022’ and click on the cell corresponding to the first revenue line item. Fortunately, tools like Google Sheets or Excel allow you to set up templates, so you can forget about the calculations and focus on analysis. Using Layer, you can also automate data flows and user management, so you can gather the data automatically, carry out the analysis, and automatically share results and reports with the right users.