Current Ratio Definition, Explanation, Formula, Example and Interpretation

دسته: Bookkeeping

Generally, prepaid expenses that will be used up within one year are initially reported on the balance sheet as a current asset. As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement. Current liabilities refers to the sum of all liabilities that are due in the next year. On the other hand, a current ratio greater than one can also be a sign that the company has too much unsold inventory or cash on hand.

Contents

- Current liabilities are obligations that are due to be paid within one year.

- Calculating the current ratio at just one point in time could indicate that the company can’t cover all of its current debts, but it doesn’t necessarily mean that it won’t be able to when the payments are due.

- On the other hand, the quick ratio will show much lower results for companies that rely heavily on inventory since that isn’t included in the calculation.

- Current ratios are not always a good snapshot of company liquidity because they assume that all inventory and assets can be immediately converted to cash.

- This approach is considered more conservative than other similar measures like the current ratio and the quick ratio.

For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. While the formula is straightforward, the time and effort needed to obtain and verify accurate figures to plug in were often substantial. Liquidity is crucial for financial institutions to meet sudden cash demands during market volatility.

Start free ReadyRatios financial analysis now!

However, regulators may consider a company’s current ratio as part of a broader evaluation of its financial health. Companies with shorter operating cycles, such as retail stores, can survive with a lower current ratio than, say for example, a ship-building company. The current ratio should be compared with standards — which are often based on past performance, industry leaders, and industry average.

Editorial disclosure

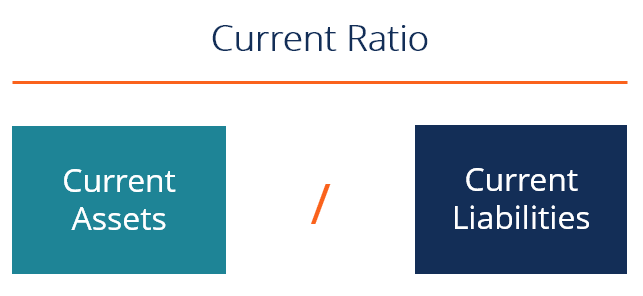

In other words, it is defined as the total current assets divided by the total current liabilities. The current ratio or working capital ratio is a ratio of current assets to current liabilities within a business. To compare the current ratio of two companies, it is necessary that both of them use the same inventory valuation method. For example, comparing current ratio of two companies would be like comparing apples with oranges if one uses FIFO while other uses LIFO cost flow assumption for costing/valuing their inventories. The analyst would, therefore, not be able to compare the ratio of two companies even in the same industry.

Just a test of quantity, not quality:

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Resources

Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room. A current ratio lower than the industry average could mean the company is at risk for default, and in general, is a riskier investment. In this example, Company A has much more inventory than Company B, which will be harder to turn into cash in the short term. Perhaps this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet. Company B has more cash, which is the most liquid asset, and more accounts receivable, which could be collected more quickly than liquidating inventory.

Although the total value of current assets matches, Company B is in a more liquid, solvent position. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. The cash ratio measures your company’s ability to cover short-term obligations using only cash and cash equivalents. This formula quantifies the proportion of current assets available to cover each dollar of current liabilities. It provides an indication of a company’s short-term liquidity position and its ability to meet its immediate financial obligations.

Your company has R500,000 in current assets, R100,000 in inventory, and R200,000 in current liabilities. It’s ideal to use several metrics, such as the quick and current ratios, profit margins, and historical trends, to get a clear picture of a company’s status. The current ratio can be useful for judging companies with massive inventory back stock because that will boost their scores. On the other hand, the quick ratio will show much lower results for companies that rely heavily on inventory since that isn’t included in the calculation. If the current ratio is too high (much more than 2), then the company may not be using its current assets or its short-term financing facilities efficiently. As mentioned above, the current ratio tells investors whether or not a company can pay its short-term obligations.

Analysts also must consider the quality of a company’s other assets vs. its obligations. If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default. Traditionally, calculating the quick ratio was a manual process, where finance teams would pull data from various sources, including balance sheets and accounts, software outsourcing in romania to gather current assets and liabilities. First, the quick ratio excludes inventory and prepaid expenses from liquid assets, with the rationale being that inventory and prepaid expenses are not that liquid. Prepaid expenses can’t be accessed immediately to cover debts, and inventory takes time to sell. Commonly acceptable current ratio is 2; it’s a comfortable financial position for most enterprises.

In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio. For example, a normal cycle for the company’s collections and payment processes may lead to a high current ratio as payments are received, but a low current ratio as those collections ebb.

The current ratio reflects a company’s capacity to pay off all its short-term obligations, under the hypothetical scenario that short-term obligations are due right now. The Current Ratio is a measure of a company’s near-term liquidity position, or more specifically, the short-term obligations coming due within one year. In this case, current liabilities are expressed as 1 and current assets are expressed as whatever proportionate figure they come to.